Money in Sport wrote a post in February about INEOS splitting with Sir Ben Ainslie’s sailing team. The story then was that INEOS planned to set up its own team for the next America’s Cup. Fast forward to June and the INEOS sports sponsorship program has now largely imploded.

Mea culpa for not joining the dots on what was happening at INEOS as the first post went out in February…

Here’s an updated version of the chart from the February post setting out INEOS’s sports interests:

Events since February:

The New Zealand Rugby Union announced in February that it was taking legal action against INEOS for unilaterally terminating its 6 year sponsorship of the All Blacks which began in 2022. In April there was a press release by NZRU confirming that the legal claim had been settled on terms which remain confidential.

INEOS announced in April that it had withdrawn its intention to challenge for the next America’s Cup. It blamed Athena Racing, owned by Ben Ainslie, for a six month delay in finalising the agreement:

“The decision has been taken after a protracted negotiation with Athena Racing Ltd following the conclusion of 37th America’s Cup, last year in Barcelona. The agreement that had been reached with Athena Racing would have allowed both parties to compete in the next Cup but it depended on a rapid resolution. INEOS Britannia had agreed the substantive terms very quickly, but Athena has failed to bring the agreement to a timely conclusion. INEOS Britannia is of the opinion that this six-month delay has undermined its ability to prepare for the next Cup and so has reluctantly withdrawn its intention to challenge.”

Did Ratcliffe seriously expect Athena to play ball on the agreement given the deterioration in his relationship with Ben Ainslie? Schoolboy error…

Ainslie will have been focused on finding new sponsors to back his team for the next AC. Athena is unlikely to be challenged by other British teams now that INEOS has withdrawn.

Last week it was reported that Tottenham Hotspur is taking legal action against INEOS Automotive over a Grenadier 4x4 endorsement deal that was unilaterally terminated by INEOS. That brings Sir Jim Ratcliffe into conflict with Daniel Levy, the Chairman of Spurs with a fearsome reputation for toughness….sparks might fly!

As noted in the Money in Sport F1 post last week, INEOS apparently tried to renegotiate its sponsorship with the Mercedes F1 team in which it has 33.3% ownership. The sponsorship was worth in excess of £50 million per season. Sky Sports reported comments on INEOS by Toto Wolff in February:

"Jim Ratcliffe is one of us three amigos - Mercedes, Jim and I. We are never going to part ways. He's been a great sponsor. We have had projects together. Nothing you read in the news will change anything."

Despite this “move along, nothing to see here” message from Toto almost all evidence of INEOS’s sponsorship has been removed from the Mercedes F1 cars this season suggesting that the sponsorship is now worth far less to the F1 team than in the last 3 seasons.

INEOS’s major sporting investment is its 29% shareholding in Manchester United costing $1.65 billion. INEOS has control of footballing operations and has implemented major cuts in staffing under the umbrella of a transformation plan announced in February:

“Manchester United is to transform its corporate structure as part of a series of additional measures to improve the club’s financial sustainability and enhance operational efficiency.

The transformation plan aims to return the club to profitability after five consecutive years of losses since 2019. This will create a more solid financial platform from which the club can invest in men’s and women’s football success and improved infrastructure.

As part of these measures, the club anticipates that approximately 150-200 jobs may be made redundant, subject to a consultation process with employees. These would be in addition to the 250 roles removed last year.”

Lastly, the INEOS Grenadiers cycling team is about to embark on the Tour de France which starts this weekend. The team faces an uncertain future given the cost cuts which INEOS is making across the board.

INEOS financials

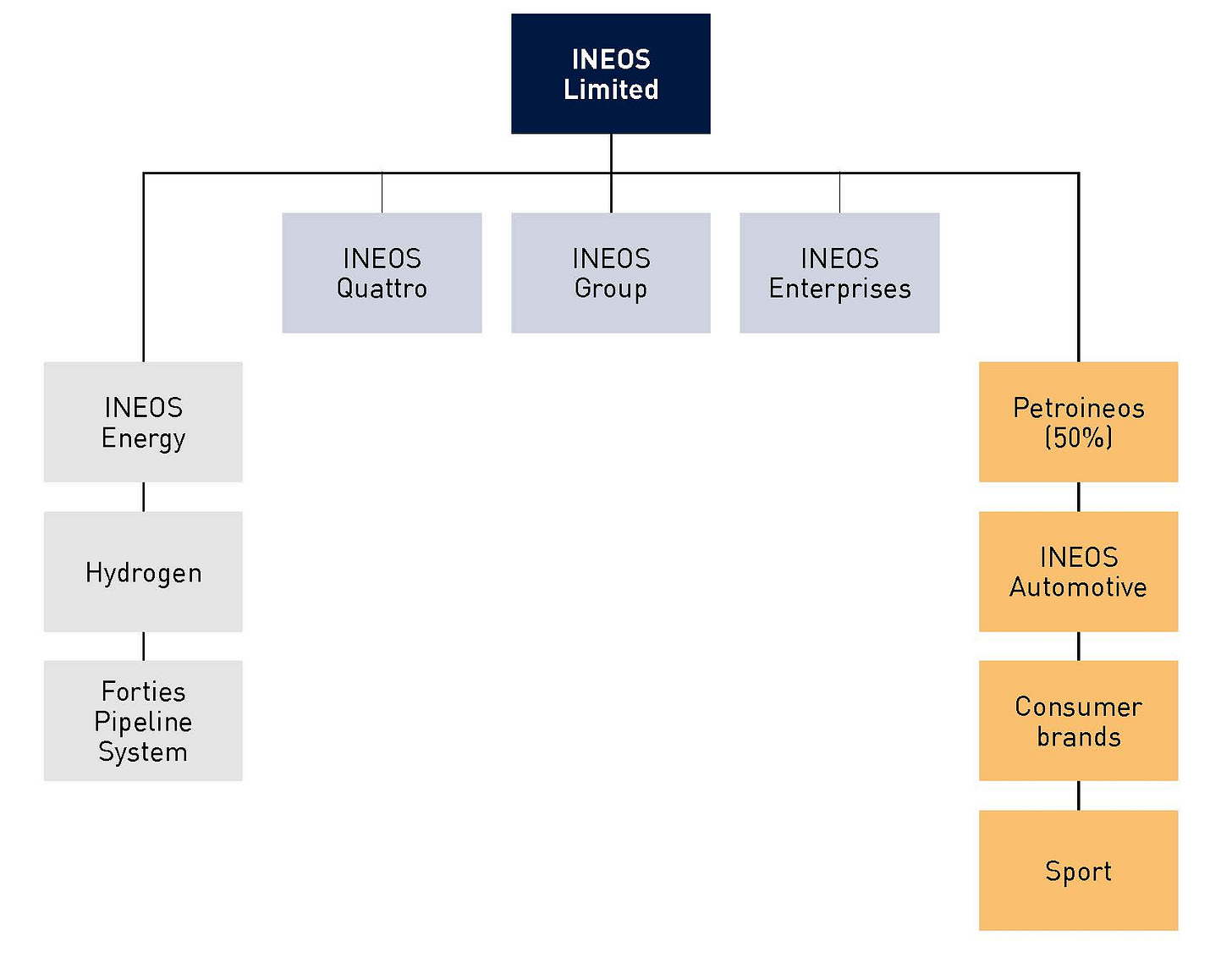

INEOS is difficult to analyse given that it is a privately owned organisation. Its group structure is incredibly complex and key parts of the Group are domiciled in jurisdictions which don’t require public disclosure of financial statements, including the top company based in the Isle of Man. The INEOS corporate website provides this rather simplistic organisation chart:

Based on the chart, Money in Sport reviewed the financials for the following three key subsidiaries of INEOS Limited, the top company in the group:

INEOS Group Holdings SA (Luxembourg) - financials posted online by INEOS. Fitch Ratings credit reports also available.

INEOS Enterprises Holdings Limited (UK) - owned by INEOS AG (Switzerland).

INEOS Industries Limited (UK). This company owns INEOS Quattro Holdings Limited (UK) and INEOS Industries Holdings Limited (UK) which owns INEOS Automotive and most of INEOS’s sporting investments, including Tour Racing (cycling), Mercedes-Benz Grand Prix (F1), INEOS Racing and OGC Nice (football).

The charts below show how INEOS was flying high in 2021-22 and then suffered a dramatic 27% decline in aggregate revenues of these 3 key subsidiaries in 2023. This led to a 49% downturn in EBITDA (profitability) in 2023:

The deterioration in trading in 2023 impacted operating cash flows and elevated net debt across the 3 companies:

The Net Debt chart highlights the most concerning issue for Sir Jim Ratcliffe and his two co-shareholders, given the volatile global economic environment. In 2024 net debt for INEOS Group Holdings deteriorated further so there is no evidence this issue is under control yet on a group basis. Presumably Ratcliffe had no choice but to cut costs across the board, including sports sponsorship budgets. This has had a devastating impact on INEOS’s reputation in the sporting world.