Is the PGA Tour in financial trouble?

Was last week's landmark agreement with the Saudi PIF triggered by cashflow problems?

A widely-held theory behind last week’s merger landmark agreement between the PGA Tour and the Saudi PIF is that the Tour must be running out of cash. There seems no other credible explanation for the sudden reversal of the Tour’s hostility towards the Saudis.

This article analyses the PGA Tour’s financials as disclosed in its most recent Form 990 filed for 2021 in the search for evidence to support or refute this theory….

Are there signs of financial stress?

Yes! Here is a summary of the detailed analysis which follows below:

1. Tournament prize money and player bonuses are projected to be $220 million higher in 2023 compared to 2021…that is a 50% increase in only 2 years! This is a result of enhanced bonuses and the introduction of elevated events with $20 million purses. Unfortunately, sponsors seem unwilling to increase their tournament funding, leaving the Tour to absorb the additional players’ prize money and bonuses. Costs +$200 million?

2. Legal fees were reported by The New York Times recently to have ballooned to $40 million, a 20-fold increase vs 2021 fees in Form 990. Costs +$38 million?

3. In 2021 the Tour enjoyed windfall income of $168 million from securities trading. This is clearly not its core business and it’s reasonable to assume that this income is probably not recurring in future. Financial revenue -$100 million?

4. The Tour has a portfolio of subsidiaries which collectively are losing money and draining huge amounts of cash from the top company, PGA Tour Inc. The annual losses in this portfolio have been cancelling most of the profits earned by PGA Tour Inc consistently over the last 5 years. A restructuring plan is needed to turn around or jettison under-performing portfolio companies. For instance, the TPC Network of 30 courses includes 11 which are owned and operated by the Tour… probably a luxury the Tour can no longer afford. Annual recurring subsidiary losses $30-50 million?

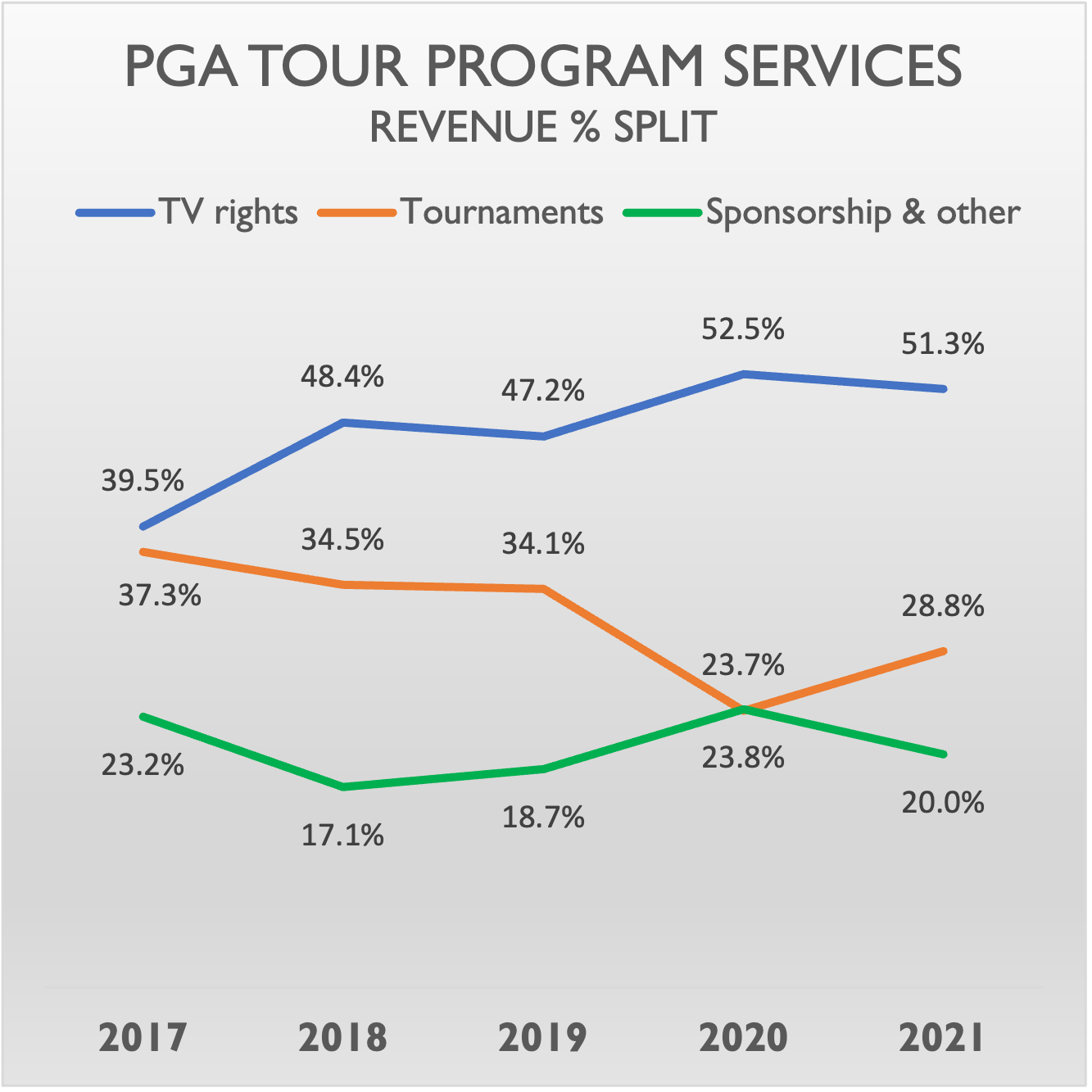

5. The Tour is increasingly reliant on revenue from TV Rights which makes up over half of its operational revenues (excluding financial income). This revenue stream amounted to $583 million in 2021 and could be at risk in future unless TV ratings show sustained improvement. That’s a huge challenge for the Tour given the departure of so many stars to LIV Golf since 2021.

6. The compensation paid to the senior executives of the Tour seems to be running somewhat out of control. The levels of bonuses and incentives seem excessive and it’s hard to see a linkage to the financial performance of the Tour and its subsidiaries. 13 executives earned over $1.025 million in total compensation in 2021, a level which would have placed them in the top 125 of the Tour Money List for season 2021-22.

7. The Tour exercises influence over DP World Tour via a minority shareholding in the European Tour TV production company, PGA European Tour Productions (ETP). However, this series of transactions has not yet completed and represents a potential drain on the Tour’s cash resources. Potential cash outflow $200-250 million?

IRS Form 990 for PGA Tour Inc

Before we dive into the detail on the Tour financials, it’s essential to understand that Form 990 only includes the financials for the top company, PGA Tour Inc. It does not consolidate the financials for the Tour’s 100% owned subsidiary PGA Tour Holdings Inc and all of its companies.

However there are details buried in the various Schedules to Form 990 which provide clues on what the overall picture looks like.

PGA Tour Inc Balance Sheet (2021):

At first glance the Tour’s balance sheet looks to be in good shape with reserves of $1.25 billion at the end of 2021 (line 31) representing accumulated annual surpluses from 2021 and prior years.

Assets include a listed investment portfolio worth $2.1 billion (line 11). However the bulk of this is linked to players’ retirement plan balances of $1.8 billion (included in line 25) which grew 53% between 2018 and 2021.

[BTW, there was no disclosure of the players’ retirement plan balances in Form 990 for 2019 and 2020, presumably due to preparation errors.]

The Tour’s investment in PGA Tour Holdings of $631 million (included on line 12) exceeds the assets of Holdings of $393 million at the end of 2021, a deficit of $238 million. This is an unhealthy situation…the persistence of deficits like this since 2017 is grounds for an impairment charge in the Tour’s books.

The Tour has injected $241 million of new capital into PGA Tour Holdings since 2016. There is no evidence of returns having been generated by these investments since Holdings continues to report annual losses which will be addressed later in this article.

Capital injected into Holdings: 2016: $130 million; 2017 $66.1 million; 2020 $45 million

Notes receivable assets total $1.1 billion (line 7) which is an exceptionally high balance and a significant concern. Unfortunately, no details are provided in Form 990. It’s reasonable to assume that this balance represents inter-company lending to PGA Tour Holdings and its subsidiaries. If so, this is a bad sign….it indicates cash flow problems in the Tour’s portfolio of subsidiaries, despite the regular injections of new capital mentioned above. These notes could prove illiquid in the event that the Tour seeks repayment in future.

[BTW, if the $1.1 billion of notes receivable includes significant loans to third parties that should trigger questions about the Tour’s corporate governance.]

The Tour acquired an initial stake in European Tour Productions (ETP) of 15% for $85 million, of which $30 million was paid in January 2021 with the balance to be paid in 4 annual instalments of $13.75 million. In June 2022 the Tour proposed to acquire a further 25% of ETP, although it’s not clear if this transaction has been finalised. This additional 25% stake could cost the Tour in the range of $150-200 million, assuming DP World Tour insists on a premium over the original transaction for the dilution in control of its most valuable asset (aside from its Ryder Cup rights).

There are offsetting payables to affiliates of $745 million in the liabilities section of the 2021 balance sheet (included in line 25). The scale of these inter-company balances, receivables and payables, is unhealthy.

Cash balances total $230 million (lines 1 & 2) which represents only 2 months’ operating expenses of PGA Tour Inc on average. This doesn’t leave the Tour with much of a buffer for one-off or unexpected cash requirements, given the relatively illiquid nature of many of its assets and the need to ringfence its securities portfolio.

PGA Tour Inc Income Statement (2021):

PGA Tour Inc has been profitable over the years, although the profit trend has been declining since 2019. The concern is that the Tour’s annual surpluses (line 19) are being offset by persistent losses incurred by PGA Tour Holdings and its subsidiaries:

Cost growth is a significant problem for the Tour in 2022 and 2023 and beyond as a result of huge increases in Tour prize money and bonuses. In 2022, prize money increased by $49 million and player bonuses - including FEDEX Cup and PIP - increased by $91 million; +$140 million in total. In 2023, tournament purses will increase by a further $87 million mainly due to the new $20 million purses for elevated events. To date sponsors appear to have been reluctant to increase their tournament budgets, forcing the Tour to absorb most of the cost of increased prize money and bonuses. Clearly this is not sustainable.

The Tour is increasingly reliant on TV rights income which comprised over 50% of its operational revenues in 2020 and 2021.

The compensation paid to senior Tour executives listed in Schedule J of Form 990 should be a source of concern to the players:

1. Bonuses and incentives appear to be out of control. In the absence of details on the incentive schemes it is hard to be specific on where the issues lie. It seems likely that there are few caps in place to limit such enormous payouts. Also, it’s hard to discern how the bonus pools generated were linked to the performance of the Tour and its subsidiaries on a short-term or long-term basis.

2. If the 2021 executive compensation is compared to the Tour Money List for season 2021-22, 13 executives would have broken into the top 125 ($1.0 million cut-off) based on their total compensation. 5 executives would have ranked on the top 50 money list ($2.6 million cut-off) and the 2 most senior executives would have placed in the top 5 earners including the Tour Commissioner who almost earned as much as Scottie Scheffler who topped the Money List for 2021-22 with earnings of $14,046,910.

In 2021 the Tour enjoyed a windfall of $168 million from securities trading. The Tour is clearly not in the business of stock market speculation and therefore it’s likely that 2021’s securities trading income is not sustainable:

The New York Times reported on June 10 that the Tour’s legal fees had swelled to $40 million as a result of the litigation with PIF and LIV Golf. That’s a 20-fold increase over the levels of fees incurred in recent years, per Form 990:

The Tour prides itself on the generosity of its charitable giving but there are signs that it’s struggling to maintain donation levels. The players could face a public backlash if their demands for enhanced prize money and bonuses results in the Tour having to slash its charitable giving in the future.

‘WGF’ is the World Golf Foundation which has been the largest single beneficiary of the Tour’s charitable giving. In the last 10 years, the Tour contributed $144 million in cash and other assistance to WGF.

Lastly, PIF to carry out due diligence?

Normally a professional investor would carry out extensive due diligence on businesses and commercial rights which are proposed to be contributed by PGA Tour Inc and DP World Tour to the Newco envisaged under the landmark agreement announced last week. Currently, there are no details on which assets are transferring to Newco and which are being left behind in PGA Tour Inc. The due diligence process could be far from straightforward, for example, if the Tour tries to jettison under-performing assets to Newco.

The recent transactions which cemented the Tour’s influence over DP World Tour provide a reminder of the risks involved. The European Tour incurs losses every year on a group basis, except once in every 4 year cycle when it hosts a lucrative home Ryder Cup match. As a result, the PGA Tour elected to invest in the European Tour’s production subsidiary, which is consistently profitable. In cherry-picking one of the European Tour’s jewels, the Tour minimised its exposure to losses elsewhere in the European Tour group of companies. However the European Tour’s long-term viability is now less certain, an issue which I wrote about a few months ago on this ‘Money in Sport’ page.

Wrap up

Please let me know what you think of this analysis. If you can shed light on any of the issues I’ve raised, please comment….I’ll happily revise this article if any assumptions are incorrect.