The recent PGA Championship at Quail Hollow prompted Money in Sport to pull up the 2024 form 990 for the PGA of America to check out its financials. It turned into a bigger assignment than anticipated, due to the sprawling nature of the organisation. The maxim “if you find yourself in a hole, stop digging” came to mind on several occasions but Money in Sport persevered! Here is a summary of the findings:

PGA of America structure - there is a lack of disclosure on the results of the commercial subsidiaries, especially the group of companies under PGA Corporation. Consolidated financial statements are available online for 2019 and 2020; why did the PGA of America stop publishing this information? The structure is overly complex and needs to be simplified.

Revenue volatility - three filters are required to make sense of the top line trends, including the impact of the Ryder Cup home and away matches every two years. Separate disclosure of Ryder Cup-related revenues is needed, along the lines of the disclosures by PGA European Tour in its Directors’ Report. The amounts paid to PGA Tour - 20% of RC broadcast fees - should also be disclosed given their materiality.

Management costs are increasing at a rapid rate, indicating regular hiring activity. However there is no disclosure of the number of employees in form 990 which is unhelpful. An annual report would be welcome providing accountability to members and other stakeholders on the effectiveness, efficiency and value for money of these people investments.

Prize funds - there is no disclosure in form 990 of the $32.4 million total prize money for the PGA of America’s Major Championships, i.e. the PGA Championship, Senior PGA and the Women’s PGA. The Senior PGA prize fund was cut by $500,000 this year (14%), offsetting a similar increase in the PGA Championship prize fund.

The PGA Foundation - more transparency over the Foundation’s expenses is required, especially management fees charged by PGA Corporation. Donors have the right to know how their contributions are being used.

The new headquarters in Frisco TX was planned to cost $30 million. The building itself ended up costing around $40 million plus additional expnditure of around $10 million on the fitout.

Investment portfolio valued at $228 million in March 2024. This is part of a wider problem in the game. Golf’s governing bodies are hoarding over $1 billion in their investment accounts instead of using those funds to “Grow the Game”… a collective failure of imagination as to how these funds could be used.

Section financials - there is a significant disparity between the financial health of the 41 sections. For instance Southern California shows $13 million of assets in its latest form 990 whereas Utah Section has a deficit on its balance sheet and is being kept afloat by a loan from its Junior Foundation. It seems inevitable that there will eventually be a rationalisation of the 41 Sections with stronger and better run Sections absorbing weaker neighbours.

Section foundations - the foundation collaboration models used in Tennessee, Indiana and Kentucky involving PGA sections, State golf associations and First Tee programs are worthy of consideration by other sections operating their own foundations. Pooling resources in a state or area has merit and makes for easier conversations with donors who might otherwise have to choose between competing local golf foundations.

The PGA of America structure

A diagram summarising the structure of The PGA of America is required given the complexity of the organisation:

The obvious point to make is that the organisation structure does not need to be this complicated. A simplification exercise is required.

The PGA of America form 990 only covers the activities of the 501(c)(6) nonprofit. It doesn’t include any of the commercial businesses it owns, including PGA Corporation and all its subsidiaries. The revenues and net assets of the various subsidiaries are required to be disclosed in Schedule R of form 990 but PGA of America chooses not to which is bad practice.

The 41 Sections operate as separate 501(c)(6) nonprofits and file their own form 990s which Money in Sport reviewed as part of this exercise. In addition, each of the Sections has a Foundation which operate as 501(c)(3) charities.

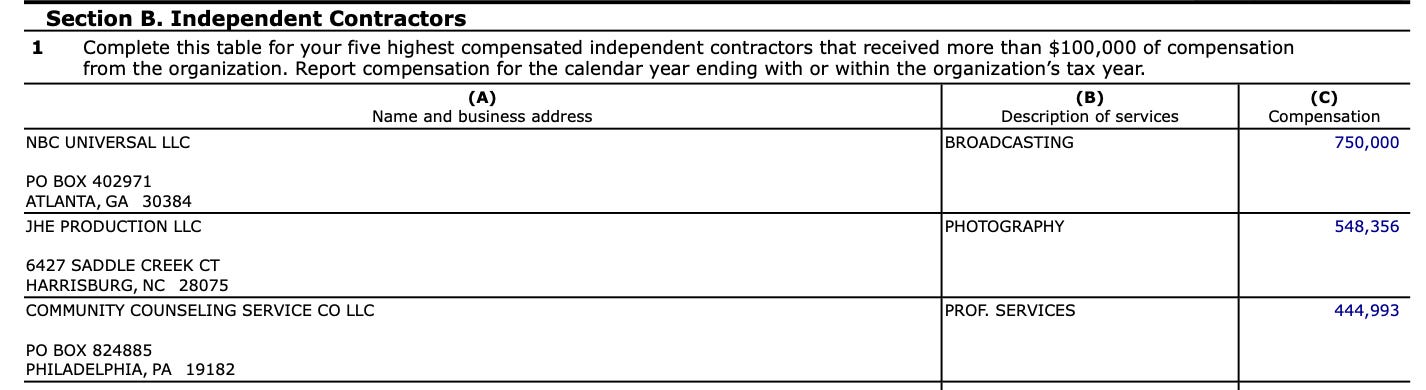

To understand the scale of the organisation, the latest financials for each of the 501(c) entities show the following revenues and net assets:

Revenue trends

The charts show program services revenues, excluding investment income and securities sales:

At first glance the chart of PGA annual revenues looks volatile, albeit with a clear upward trend. Three filters are required to better understand the underlying trends.

Filter 1: Break out tournament revenues from other revenue lines, such as education and membership dues, to isolate the source of the volatility.

Filter 2: Recall that PGA controls the rights to Ryder Cup matches in US. To properly understand tournament revenues, it is necessary to break out the revenues for Ryder Cup years.

Filter 3: For Ryder Cup years, separate the revenues for home and away matches since PGA European Tour controls matches in Europe.

Ryder Cup revenues are growing strongly, especially in years with home matches in US. The latest price for a ticket for Ryder Cup Sunday play at Bethpage is $1,249 courtesy of SeatGeek, the official ticket agent. Presumably the PGA of America is taking a cut of the extortionate fees levied by SeatGeek on the purchase of each resale ticket, in addition to the $750 already collected for the original match day ticket:

In non-Ryder Cup years, revenues took off in 2021 due mainly to heightened public interest in the Majors following the establishment of LIV Golf which created a situation where the four major championships are now the only events where the top players compete against each other. It’s also conceivable that the PGA of America is finding ways to generate additional income from Ryder Cup sponsors in non-Ryder Cup years.

Management costs

PGA of America management costs have been increasing at a rate far-exceeding the growth in its revenues:

Revenues increased by $64 million (+59%) since 2015. Management costs increased by $68 million (+450%) in the same period. The variances imply that all incremental revenues have been ploughed into additional staffing at PGA of America. We can’t confirm this because the PGA of America doesn’t disclose the number of employees in its form 990 report since they are legally employed by its subsidiary PGA Corporation. The use of a technical loophole like this to avoid disclosure is unworthy of the organization.

The PGA’s senior executive compensation costs are set out in Schedule J of form 990 for the year to 31 March 2024. The comparison with the latest Schedule J information for USGA and PGA TOUR shows:

Clearly the PGA TOUR’s executive compensation is out of control, especially incentives which equate to an astronomic 375% of base compensation on average… an egregious abuse. The PGA TOUR professionals and their advisors are clearly not paying attention to this issue…wake up people!

Major championship prize funds

The prize funds for the PGA Major Championships have doubled in the last 10 years:

There is no disclosure of the prize funds for the Major Championships in the PGA of America’s form 990. The Women’s PGA is sponsored by KPMG and the Senior PGA by KitchenAid so the impact on the PGA of America’s expenses would be lower than the combined prize funds of $32.4 million.

Interestingly the prize fund for the Senior PGA was reduced by $500,000 this year compared to 2024, offsetting the increase in the PGA Championship prize fund:

The PGA Foundation

The PGA of America REACH Foundation focuses on Junior golf, Military and Underserved Communities programs. The Foundation has been successful in raising money from the public and other external sources. 26% of the Foundation’s income arose from contributions from PGA of America in the year to 31 March 2024:

The Foundation’s form 990 indicates that it employs no staff. All PGA of America staff are employed by its subsidiary, PGA Corporation which then recharges those costs to each company in the structure, including the Foundation.

The trend of increasing management fee recharges to the Foundation over the last 5 years is concerning:

‘Fees for services - Management ($3,413,450)’ are recharges from PGA Corporation for allocations of the costs of management and employees.

It is unclear what ‘Fees for services - Other ($2,453,812)’ represents. This item exceeds 10% of total functional expenses and should therefore be analysed on Sch O:

Clearly not a helpful analysis! More transparency by the Foundation would be helpful to donors wondering how their contributions are being used.

Elsewhere in the form 990 we learn that the Foundation employs independent contractors for broadcasting (NBC Universal), photography (JHE Production, now part of Wasserman) and fund raising (CCS), at significant cost:

The Foundation made modest grants to external charities and nonprofits until 2024 when it made substantial grants to the foundations of each of the 41 PGA sections, totalling $4.7 million.

In summary, the Foundation received $3.7 million in grants from PGA of America and paid $3.4 million in management fees to PGA Corporation, giving a net income from PGA of America of $275,000. Given the PGA of America’s total revenues of $172 million in 2024 this seems a rather meagre contribution towards the good work the Foundation does.

Frisco TX headquarters

The net book value of PGA of America’s fixed assets increased from $5.1 million in March 2020 to $55.5 million in March 2022 indicating a total capital expenditure of $50 million around the time of the move to the new headquarters in Frisco TX. The building itself was originally planned to cost $30 million but ended up costing closer to $40 million.

Investment portfolio

The PGA of America has a significant portfolio of listed investments, totalling $228 million at 31 March 2024:

It is not the only governing body sitting on a huge securities portfolio. The combined portfolios of USGA, PGA of America and The R&A in UK total over $1 billion. This is money which could be deployed in “grow the game” initiatives. Instead it is helping to keep their stock brokers gainfully occupied which represents a failure of imagination as to what could be done with funds on such a large scale.

Section financials

The charts show the top 10 sections by revenue and net assets, based on their latest form 990s:

The smallest Sections by revenue and net assets are:

The disparity between the largest and smallest Sections by revenue and net assets is striking. Clearly some Sections are healthier and run more effectively than others.

Historical note: The PGA of America comprised 7 sections when it was set up in 1916. In 1921, it broke up the original sections and formed 41 new sections. Given the shaky finances of some sections currently, rationalisation might be needed in the future to make the PGA Section structure more efficient.

Section foundations

The top 10 Section foundations are as follows:

The Tennessee, Indiana and Kentucky golf foundations operate in collaboration with State golf associations and local PGA Sections. The First Tee program is also a partner of the Tennessee and Indiana golf foundations. This partnership model for foundations could be looked at in other states, especially where there are overlapping programs in junior golf and other areas of local focus.