Trump Organization Irish golf investment turns around.... finally!

Doonbeg records its first ever PBT in 2023. "MAGA-millions" projected during second Presidency....

President Trump’s Doonbeg property in Ireland released its 2023 financials last month, showing respectable 12% revenue growth and a modest profit. It turns out this is the first annual profit in its history going back to the course opening in 2002. Money in Sport was intrigued as to why it took 21 years to turn a profit and took a deep dive into the Doonbeg financials looking for clues.

Where is Doonbeg?

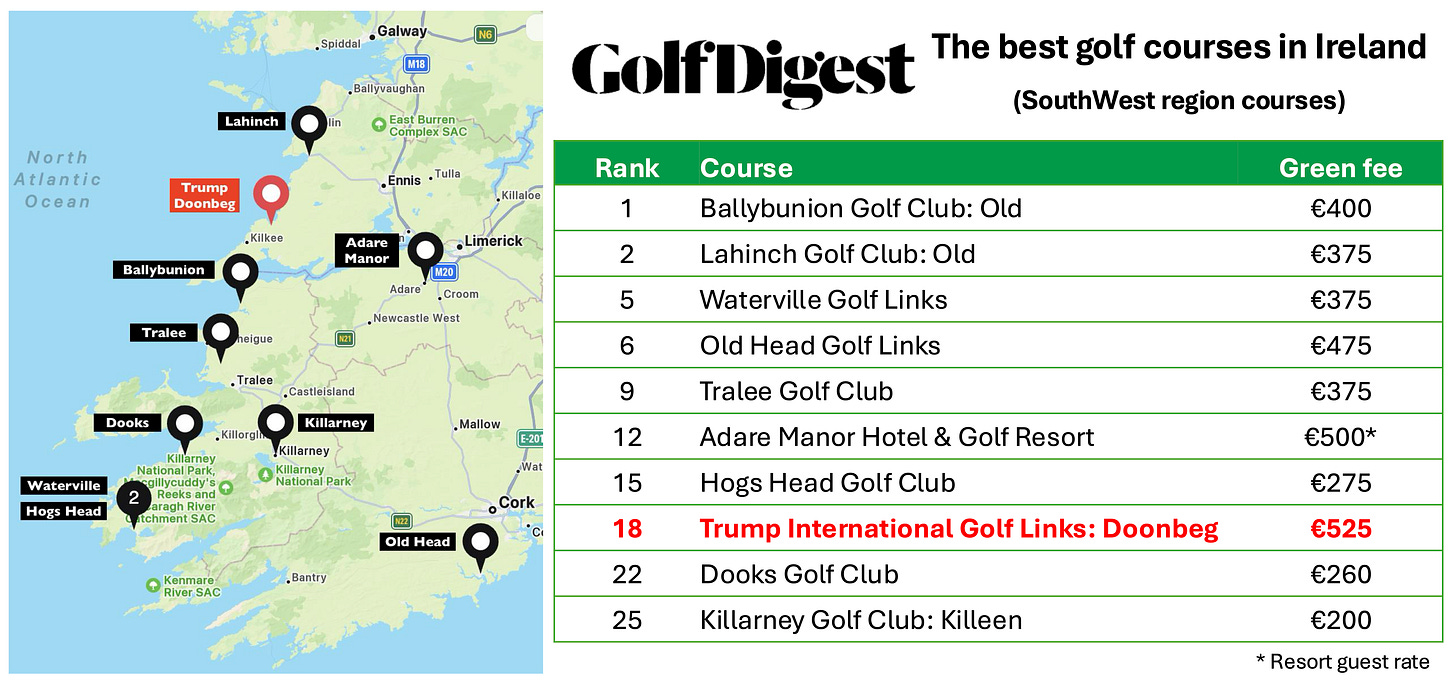

Doonbeg lies on the Southwest coast of Ireland in a region well-stocked with fabulous golf courses:

Timeline

The official course opening was marked with an exhibition match between the original course designer, Greg Norman, and Pádraig Harrington. Norman won 2&1, shooting a 5-under 67. Money in Sport enjoyed this anecdote recounted by Liam Kelly:

“Once the official opening and the Norman/Harrington match was finished, it was party time in the village of Doonbeg. And what a party! The Doonbeg owners had planned for 700 people at the celebrations, but estimates were that at least twice that number thronged the streets and had a great time. Music, craic, fireworks, happy throngs of men, women and children made Doonbeg a special place on that night of nights.”

Doonbeg performance under original ownership

The original developers of the Doonbeg golf course and lodge were Kiawah Partners, the master developer of Kiawah Island in South Carolina.

Doonbeg revenues in the early years mostly related to real estate rather than golf and hotel income. Then the GFC hit in 2008 and real estate sales dried up. The businesses were losing between €6-7 million per year in the period 2007-11, wiping out the remains of the original capital invested by Kiawah Partners. This triggered additional shareholder loans each year to keep the businesses afloat:

The Trump deal for Doonbeg

A dispute between the owners of Kiawah Partners led to its sale to South Street Partners in 2013, a private equity real estate investor backed by King Street Capital LP. Six months later, the new owners of Doonbeg had seen enough and called in the receivers. The Trump Organization (TTO) stepped in and acquired Doonbeg in January 2014 purchasing assets totalling €10.7 million (~$14.6 million at Jan 2014 FX rates):

Incidentally the original cost of the assets TTO acquired was approx €50 million, i.e €39.5 million for the golf course and lodge plus €11 million for real estate inventory. The price paid by TTO corresponded to around 20 cents on the dollar vs the original cost of the assets.

Doonbeg under TTO management

Revenue under TTO management is trending positively, with the exception of the pandemic years, 2020-21. The revenue figure is not broken down by segment in the financials so it’s unclear how much real estate sales are contributing vs regular hotel and golf course income.

Green fees have risen 3X from €185 after the course originally opened to €525 (~$540) in the 2025 high season. This makes it the highest green fee in the Southwest of Ireland, similar to the strategy being employed at Turnberry where visitor green fees will be £1,000 (~$1,200) at peak times during the high season this summer.

The Doonbeg businesses continued to lose money under TTO management between 2014-19. The pandemic hit results hard but the business operations turned cash flow positive in 2021 leading eventually to the first Doonbeg profit (PBT level) in 2023.

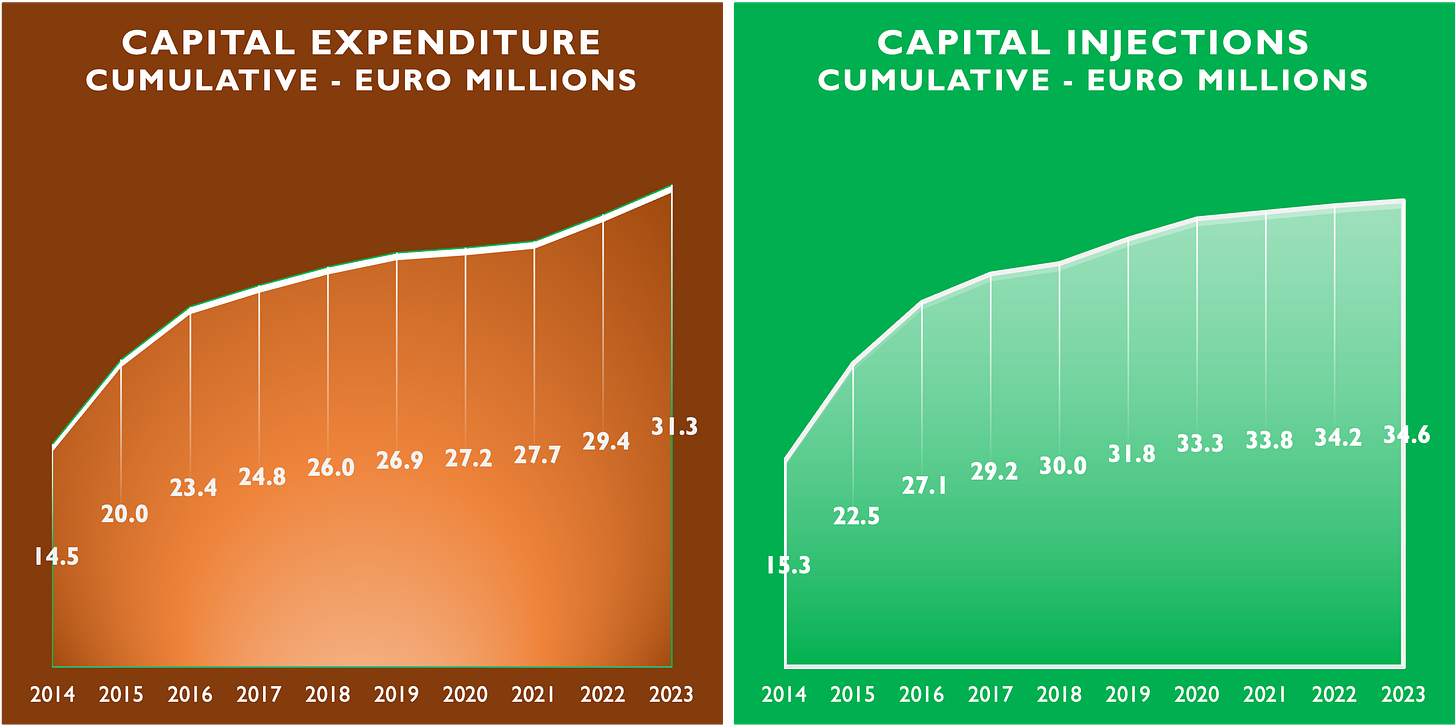

A feature of TTO ownership is its willingness to invest annually in upgrades to the course and hotel, regardless of operating losses being incurred at the time. This triggers a requirement for regular injections of fresh funds from TTO HQ in US:

The outlook for Doonbeg

Speculation in the Irish press is that Doonbeg revenues will hit €160 million over the duration of President Trump’s second term, i.e an average of €40 million per year. Assuming 2024 revenues come in around €20 million (vs €16.1 million reported in 2023), they’d have to double to achieve this projection. Management would need to ramp up real estate revenues to meet such an aggressive target.