Takeaways from Formula 1 financials, Part II

Driver pay, Liberty Media, Power Units, Silverstone and more....

Continuing Money in Sport’s deep dive into the 2023 financials for Formula 1. The first post focused mainly on the F1 teams and this week Money in Sport takes a broader look at some of the key players in the F1 eco-system, including:

F1 drivers - how much are they paid and what is a “pay driver”?

Liberty Media’s results, including the Las Vegas GP

Team valuations - are they really worth over $1 billion each?

Team ownership changes - Mercedes (how much did Toto pay for his 33% stake?), Alpine and Sauber.

F1 Power Unit suppliers

Silverstone Circuit and BRDC

Driver income

There are various rankings of driver income online, such as this RN365 2024 ranking. Max Verstappen tops the ranking with an estimated income of $55 million per season.

The ranking is not entirely reliable when you dig into its sources, “All figures of what F1 drivers make are estimates based on conversations with various sources within the F1 paddock and at various teams.”

The income of Lance Stroll of Aston Martin can be verified as it is publicly available. His father owns the team and, as a result, details of Lance’s contract for driving services are disclosed by AMR GP Limited in its “Related party transactions” note:

It seems rather shocking that Lance would have his arm twisted for sponsorship money by his father but this practice is not unusual in F1.

The concept of “pay drivers” has been around for many years. Sergio Perez is reckoned to have the most lucrative personal sponsor, billionaire Carlos Slim. The story this week in Marca is that Perez will see out his contract with Red Bull until the end of next season despite widespread speculation that he will soon be cut by the team:

The finances of the Red Bull F1 team in 2025 will affected if it slips to third place in the 2024 Constructor standings since team payments from FOWC will be cut as a result. That makes it difficult to also exit a driver who contributes a net $20 million to the team’s bottom line, assuming Marca’s information is accurate.

Liberty Media’s F1 revenues

Liberty’s revenue increased 50% between 2021 and 2023, mainly due to the explosion in interest in F1 following the success of “Drive to Survive” on Netflix. In November 2023 the inaugural Las Vegas Grand Prix took place. This is the only race where Liberty acts as the promoter of the event. It was responsible for developing and operating the circuit and the F1 paddock facilities. In return Liberty collected all the revenue from ticket sales and other commercial income which appears in “Race promotion” revenue. Liberty also sells hospitality packages for the Las Vegas race, which appears in “other revenues” above. Lastly Liberty earns revenue from race sponsorships, including the Las Vegas GP title sponsorship sold to Heineken.

Liberty’s media rights revenue is declining as a percentage of total revenue. That’s probably because its TV rights deals typically have a term of 3 to 5 years. The increased F1 audience will eventually generate additional revenue assuming these deals can be renewed at higher rates in the future.

Team Valuations

Zak Brown, the CEO of McLaren Racing, recently remarked on the soaring valuations of Formula 1 teams, stating that all 10 teams are now worth "well north of $1 billion."

Forbes published valuations for each of the F1 teams in July 2023. At that time 7 of the 10 teams were valued at $1 billion or more.

Recent F1 team transactions to use as benchmarks:

Mercedes Group sold 33.3% of its Grand Prix team to INEOS Industries Holdings Limited which disclosed, “In 2022 the Company purchased one third of the share capital of Mercedes-Benz Grand Prix Limited for consideration of €248.2 million.” That valuation looks like a bargain in comparison to the Forbes valuation of $3.8 billion. INEOS Racing sponsored the F1 team to the tune of £50 million in 2023 which presumably was agreed in parallel with the negotiation of the equity deal.

Mercedes Group also sold 33.3% of its Grand Prix team to Toto Wolff, the Team Principal & CEO, along with the INEOS transaction. How much did Toto pay? Let’s break it down based on what Mercedes and INEOS have disclosed in their financials:

Mercedes recorded a gain of €385 million for the sale of 66.7% of Mercedes-Benz Grand Prix Limited. This gain would have been calculated after deducting the book cost of the 66.7% shareholding M-B sold, i.e. €111 million. That suggests the total consideration was €496 million (€385 plus €111). This ties with the INEOS disclosure that they paid €248 million for their 33.3% stake. Presumably the consideration for Toto’s stake was equal to what INEOS paid since their stakes are equal in size.

Cash of €144 million was received by Mercedes Group in 2023 related to the GP team disposals which implies that part of the equity consideration was deferred.

The Grand Prix team has been paying out high dividends since the equity restructuring, i.e. £55.2 million in 2022, £75 million in 2023 and £100 million in 2024. These dividends would help Toto to service and pay down whatever debt he took on when acquiring his 33.3% equity stake.

Renault sold a 24% stake in its Alpine F1 team for €200 million to an American investor group led by Otro Capital, valuing the team at $900 million. This is lower than the Forbes valuation, mainly due to the fact that a minority stake like this would typically be valued on a lower multiple than a controlling stake. Money in Sport wrote an article on Substack about this transaction at the time.

Audi announced in March 2024 that it is in the process of buying 100% of the Sauber F1 team. However no financial details were disclosed which is odd. Even for a huge group like Volkswagen AG, the acquisition of Sauber at a rumoured valuation of $600 million would be a material transaction. It’s surprising that no financial disclosure has been made by VW, other than to report a 24.9% stake in Sauber Holding AG at the end of 2023 in a detailed regulatory filing in Germany1.

Earlier this week Audi denied that it was considering selling a stake in its Sauber F1 team to Qatar’s SWF (QIA). This statement implies that Audi has already acquired the remaining shares in Sauber.

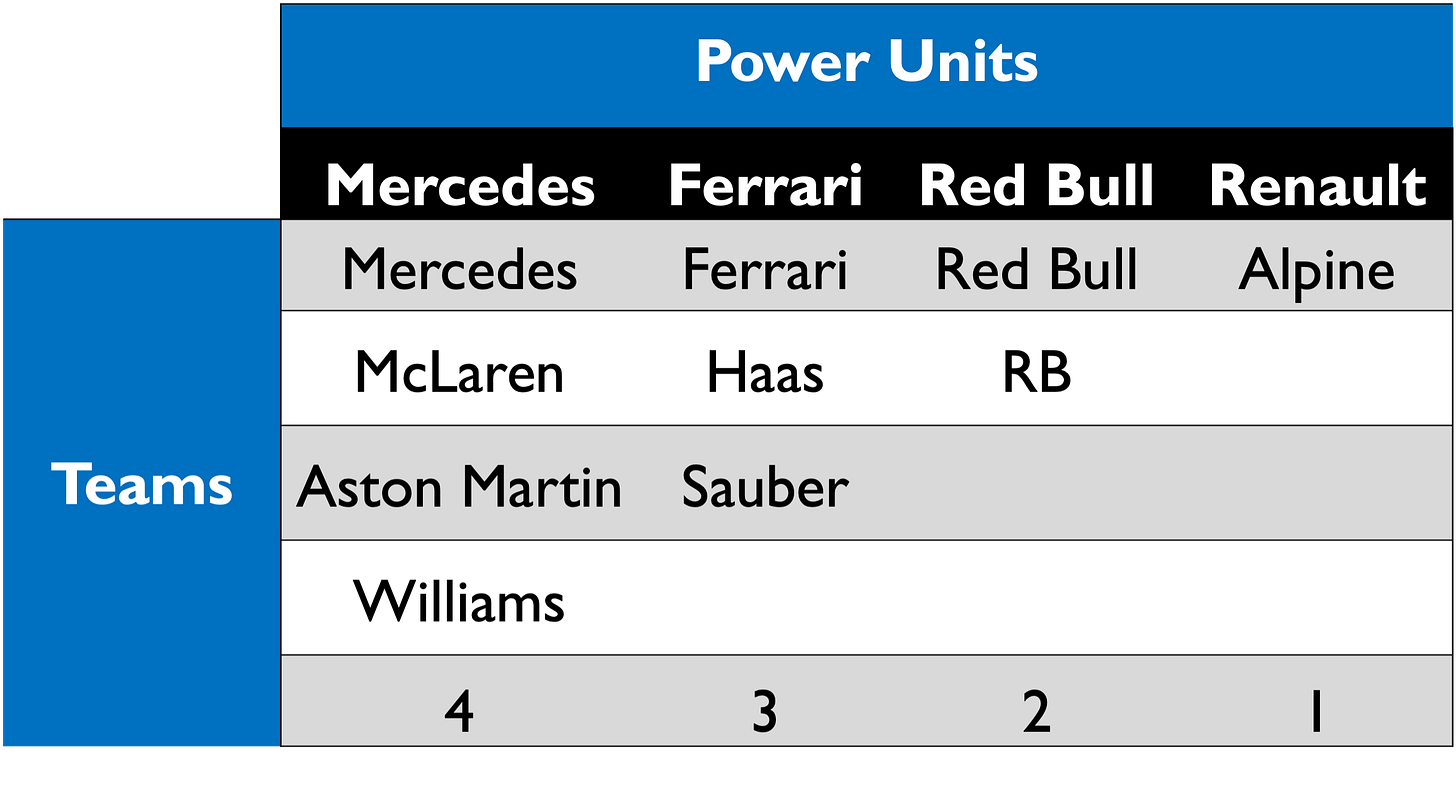

Power Units

The F1 power unit suppliers since 2021 are:

The Mercedes powertrain business is the largest which is not surprising given it supplies 4 teams in total. This business remains 100% owned by Mercedes Group. It has additional revenues not related to F1 - in 2023 it began a production run of 275 AMG One road car Power Units. It also assists Mercedes with its R&D activities, including electric vehicles.

Oddly there is no disclosure of the value of sales of powertrains to the Mercedes Grand Prix team in the Mercedes Group 2023 accounts. This lack of transparency on related party transactions is unsatisfactory and needs to be addressed by Mercedes.

Mercedes and Red Bull operate separate powertrain companies in UK2. Red Bull split its powertrain business into two companies. The original business started up in 2021 in preparation for Honda’s withdrawal from producing Formula 1 engines and is supported by Honda. The second business started up in 2022 to prepare for the new power units due in 2026 with no involvement from Honda. RB’s 2026 business now has Ford as its technical partner.

Ferrari separately discloses its engine revenues but doesn’t provide any cost information. The F1 power unit revenues can be estimated as follows:

Renault does not provide financial information on its F1 power unit activities. It has announced plans to discontinue its F1 powertrain business prior to the introduction of the new 2026 PU regulations. The Alpine F1 team is expected to switch to a Mercedes PU from 2026, replacing Aston Martin who will be using a new Honda powertrain in 2026.

Silverstone Circuit

Earlier this year Silverstone and its owners, The British Racing Drivers Club Limited (BRDC), signed a contract with Formula One extending its right to hold the British Grand Prix until 2034. Its last contract was signed in 2019 for 5 years and since then its finances have improved significantly with the only blip being the impact of COVID-19 in 2020:

The British Grand Prix makes up over half of Silverstone’s turnover each year. It attracted 480,000 fans in both 2023 and 2024 which makes it the UK’s second largest sporting event behind Wimbledon, which is played over 14 days so the comparison is not entirely fair:

Silverstone has certainly come a long way since Bernie Ecclestone, the former chief executive of Formula 1, described Silverstone 22 years ago as “a country fair masquerading as a world event.”3

Anteilsbesitz gem. §§ 285 und 313 HGB für die Volkswagen AG

Mercedes AMG High Performance Powertrains Limited, Red Bull Powertrains Limited and Red Bull Powertrains 2026 Limited

New York Times, July 4, 2024 “Silverstone Is Working to Remake Itself”